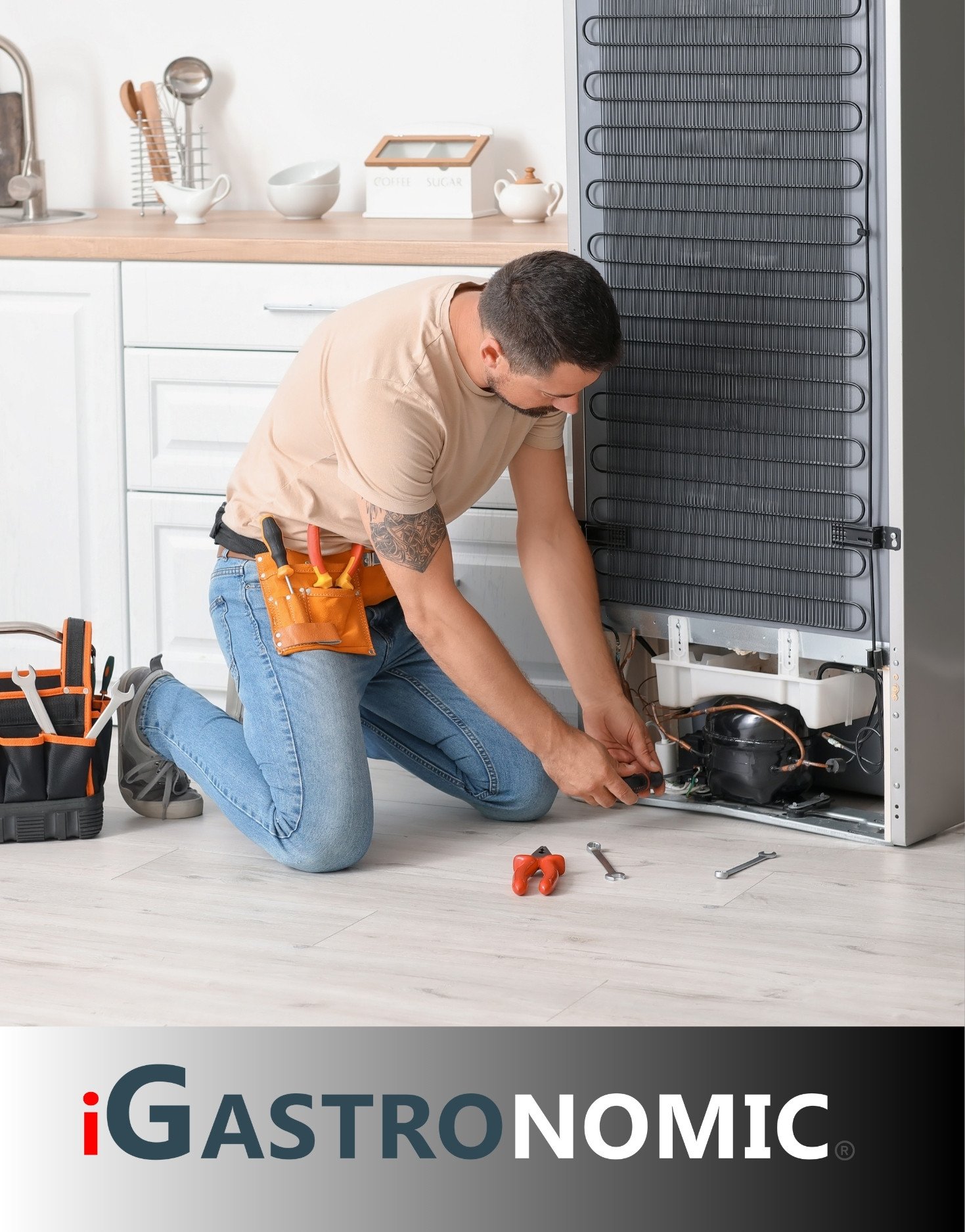

Simple maintenance tips to extend the lifespan of your kitchen equipment and save money on repairs.

-

Cooking Appliances

add remove

Cooking Appliances

add remove

-

Pizza & Grill

add remove

Pizza & Grill

add remove

-

Refrigeration

add remove

Refrigeration

add remove -

Combi Steamer

add remove

Combi Steamer

add remove

-

Kitchen Appliances

add remove

Kitchen Appliances

add remove

-

Rinsing & Cleaning

add remove

Rinsing & Cleaning

add remove

-

Retail Refrigeration

add remove

Retail Refrigeration

add remove

-

Cafe & Ice Cream

add remove

Cafe & Ice Cream

add remove

-

Smart-Gastro

add remove

Smart-Gastro

add remove

-

Cooking Appliances

add remove

Cooking Appliances

add remove

-

Pizza & Grill

add remove

Pizza & Grill

add remove

-

Refrigeration

add remove

Refrigeration

add remove -

Combi Steamer

add remove

Combi Steamer

add remove

-

Kitchen Appliances

add remove

Kitchen Appliances

add remove

-

Rinsing & Cleaning

add remove

Rinsing & Cleaning

add remove

-

Retail Refrigeration

add remove

Retail Refrigeration

add remove

-

Cafe & Ice Cream

add remove

Cafe & Ice Cream

add remove

-

Smart-Gastro

add remove

Smart-Gastro

add remove

Call us:

+49 (0) 6135 7040 450Latest posts

-

How to Extend the Lifespan of Your Kitchen Equipment with Simple MaintenanceRead more

How to Extend the Lifespan of Your Kitchen Equipment with Simple MaintenanceRead more -

The Ultimate Guide to Making the Best Brown Sugar Bubble Tea08/25/2025Read more

The Ultimate Guide to Making the Best Brown Sugar Bubble Tea08/25/2025Read moreSip into the ultimate guide for making the perfect brown sugar bubble tea, the sweet and trendy drink of the year.

-

Understanding the Total Cost of Ownership for iGastroNomic Equipment and Legal Regulations Compliance08/10/2025Read more

Understanding the Total Cost of Ownership for iGastroNomic Equipment and Legal Regulations Compliance08/10/2025Read moreDiscover the total cost of ownership for iGastroNomic equipment and how it meets legal regulations. Learn how...

-

Gas Lava Stone Grill vs Water Grill vs Griddle: Which is the Best Option for You?08/09/2025Read more

Gas Lava Stone Grill vs Water Grill vs Griddle: Which is the Best Option for You?08/09/2025Read moreGas lava stone grills, water grills, and griddles each have their own unique features and benefits, making it...

-

Air Fryer vs Oven: Which is Better for Cooking?08/08/2025Read more

Air Fryer vs Oven: Which is Better for Cooking?08/08/2025Read moreDiscover the pros and cons of using an air fryer vs an oven for cooking. Find out which appliance is better suited...

-

Secure Liquidity: Why Gastro Leasing is the Smart Choice for Your Professional Kitchen08/03/2025Read more

Secure Liquidity: Why Gastro Leasing is the Smart Choice for Your Professional Kitchen08/03/2025Read moreDiscover how Gastro Leasing helps you launch with a professional kitchen without high upfront investments, all while...

-

The Convenience of Pizza Vending Machines: A Guide to Grabbing a Quick Slice on the Go08/02/2025Read more

The Convenience of Pizza Vending Machines: A Guide to Grabbing a Quick Slice on the Go08/02/2025Read moreDiscover the convenience of pizza vending machines and how they offer a quick and easy way to enjoy your favorite...

-

Which Electric Appliances Use the Most Electricity?07/31/2025Read more

Which Electric Appliances Use the Most Electricity?07/31/2025Read moreLearn about the electric appliances that consume the most electricity and how to reduce their energy usage to save...

-

How to Clean Stainless Steel Cookware Without Scratching It07/30/2025Read more

How to Clean Stainless Steel Cookware Without Scratching It07/30/2025Read moreLearn how to properly clean and maintain your stainless steel cookware without causing any damage or scratches....

-

The Ultimate Guide to Making the Best Dubai Chocolate07/27/2025Read more

The Ultimate Guide to Making the Best Dubai Chocolate07/27/2025Read moreLearn how to make the best Dubai chocolate at home with this comprehensive guide. Discover the equipment you need and...

Blog categories

Search in blog

Archived posts

When does 7% and when does 19% VAT apply in the catering industry? The complete overview

Translation:

VAT in the Hospitality Industry: 7% or 19%? A Clear Overview

The value-added tax (VAT) in the hospitality industry is a topic that confuses many restaurateurs. When does the reduced rate of 7% apply, and when does the standard rate of 19% kick in? In this article, we'll clarify all the important questions surrounding VAT in the hospitality sector.

When Does the 7% VAT Apply?

- Takeaway Food: Whether it's a burger, pizza, or salad, if the customer takes the food away, the reduced VAT rate of 7% generally applies.

- Food for Off-Premises Consumption: This also includes food delivered or consumed at takeaways without seating areas. The VAT rate here is 7%.

- Beverages: Beverages are typically subject to the standard VAT rate of 19%, regardless of whether they are consumed on-premises or taken away.

When Does the 19% VAT Apply?

- Food Consumed on-Premises: If a customer sits down in a restaurant or bar and consumes food there, the standard VAT rate of 19% applies.

Important Exceptions:

There are some exceptions and special rules that can affect VAT calculations in the hospitality industry. These include mixed deliveries or the sale of food in conjunction with other services.

Why Is This Distinction So Important?

Correctly calculating VAT is essential for restaurateurs. Incorrectly stating the VAT rate can lead to unpleasant surprises during tax returns.

Conclusion:

VAT in the hospitality industry can be complex, but with the right information, it's easy to understand. By clearly distinguishing between takeaway food and food consumed on-premises, restaurateurs can accurately calculate VAT and simplify their bookkeeping.

Related posts

-

Reducing Costs in the Restaurant: Effective Strategies for Restaurateurs

Posted in: Finances & Operations01/15/2025In this article, you will learn how to reduce costs in your restaurant without sacrificing quality. We present...Read more

Reducing Costs in the Restaurant: Effective Strategies for Restaurateurs

Posted in: Finances & Operations01/15/2025In this article, you will learn how to reduce costs in your restaurant without sacrificing quality. We present...Read more -

Which Refrigerator is the Most Energy Efficient? The Answer for Gastronomy!

Posted in: Finances & Operations01/20/2025Looking for an energy-saving refrigerator for your restaurant? CSA-Inox offers the best energy efficiency on the...Read more

Which Refrigerator is the Most Energy Efficient? The Answer for Gastronomy!

Posted in: Finances & Operations01/20/2025Looking for an energy-saving refrigerator for your restaurant? CSA-Inox offers the best energy efficiency on the...Read more -

What Does It Really Cost to Open a Restaurant? A Comprehensive Cost Overview

Posted in: Finances & Operations01/24/2025Dreaming of your own restaurant? We'll show you what costs to expect and how to plan your budget. From pizzerias to...Read more

What Does It Really Cost to Open a Restaurant? A Comprehensive Cost Overview

Posted in: Finances & Operations01/24/2025Dreaming of your own restaurant? We'll show you what costs to expect and how to plan your budget. From pizzerias to...Read more -

What is the minimum cost to start a restaurant in Europe?

Posted in: Finances & Operations07/24/2025Discover the essential costs involved in starting a restaurant in Europe and how to budget effectively for your new...Read more

What is the minimum cost to start a restaurant in Europe?

Posted in: Finances & Operations07/24/2025Discover the essential costs involved in starting a restaurant in Europe and how to budget effectively for your new...Read more -

How to Open a Successful Kebab Store: A Step by Step Guide

Posted in: Finances & Operations07/26/2025Learn the essentials of starting a successful kebab store with this comprehensive guide. From finding the perfect...Read more

How to Open a Successful Kebab Store: A Step by Step Guide

Posted in: Finances & Operations07/26/2025Learn the essentials of starting a successful kebab store with this comprehensive guide. From finding the perfect...Read more

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.png)

.jpg)

.jpg)

(200 x 136 px) (5).png)

.png)

Leave a comment